Corporate Overview

- Since 1961 -

1961

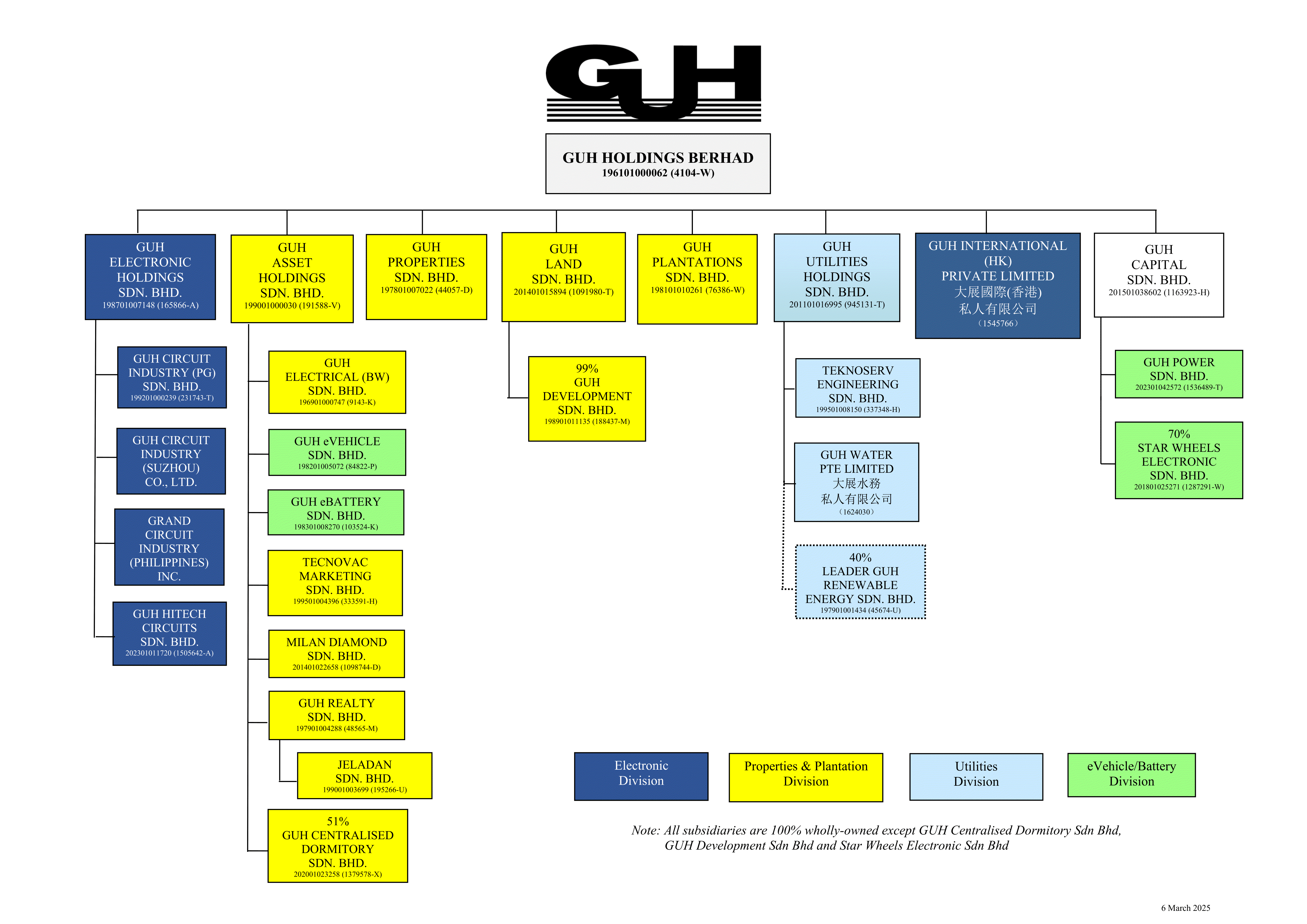

GUH Holdings Berhad is listed on the Main Market of Bursa Malaysia Securities Berhad under the Industrial Products sector. It was incorporated in the Federation of Malaya under the Companies Ordinances 1940-1946 on 1 March 1961 under the name Textile Corporation of Malaya Limited. The name was changed to Textile Corporation of Malaya Berhad when it became a public company on 30 October 1968. Subsequent to this, Grand United Holdings Berhad was adopted on 10 January 1985. On 16 June 2005, its name was further changed to GUH Holdings Berhad to reflect a common corporate identity.

1968

GUH was officially listed on the Kuala Lumpur Stock Exchange (“KLSE”) and the Stock Exchange of Singapore Limited (“SES”) on 17 December 1968. Consequent to the stock market crash resulting from the Pan-Electric Industries Limited crises in 1985, GUH requested for the suspension of trading on its shares on the KLSE and SES effective 5 December 1985. The Pan-Electric Industries Limited crisis had a significant impact on GUH as GUH was a substantial shareholder of Sigma Metal Co Ltd, which in turn was a substantial shareholder of Pan-Electric Industries Limited. GUH was subsequently de-listed from SES on 1 January 1990 in compliance with the Malaysian government’s policy.

1984

GUH was originally involved in the manufacturing and trading of cotton yarn with its only wholly-owned subsidiary Malayan Weaving Mills Sdn Bhd (“MWM”) engaged in weaving, dyeing, printing, garment manufacturing and retailing. GUH began to diversify into other activities in 1984, commencing with the acquisition of numerous companies principally engaged in property development.

In 1994, GUH implemented a restructuring scheme and acquired 100% equity interest in a few companies, namely MC Industry Sdn Bhd, which has since changed its name to GUH Electronic Holdings Sdn Bhd, and its subsidiaries that are principally involved in the manufacturing of printed circuit boards. GUH also acquired L.E.B Manufacturing Holding Bhd, now known as GUH Electrical Holdings Sdn Bhd, together with its subsidiaries which are involved in the marketing and trading of electrical goods and appliances.

GUH continues to explore and expand its business portfolio not only horizontally, but also aims to diversify into other businesses that will materialize its vision ofbecoming a conglomerate that maximizes the interest of its shareholders, employees, customers and the community.

Following this direction, GUH Properties continue its current undertaking on its mega mixed development of Taman Bukit Kepayang in Seremban, Negeri Sembilan. Optimally located adjacent to the Seremban/Labu interchange of the North-South Highway, this well-planned integrated development comprises medium to high-end residential and commercial units. Good connectivity to major trunk roads are also assured while a plethora of amenities and shopping centres are within close proximity.

2014

In 2014, GUH bought over another two companies – Notable Empire Sdn Bhd and Million Crest (M) Sdn Bhd – now known as GUH Land Sdn Bhd and GUH Development Sdn Bhd respectively. They will undertake the master development of a 46-acre freehold land in Simpang Ampat, Penang. This exquisite self-contained township will consist of lifestyle shops, residential and commercial components.

Besides that, GUH has also successfully ventured into the water/wastewater industry through its wholly-owned subsidiary Teknoserv Engineering Sdn Bhd acquired since 2012. Teknoserv’s principal activity include but is not limited to the design and build, procurement, construction and commissioning of water/wastewater treatment plants and related ancillary projects.

2015

Proposed Acquisition of 2 contiguous pieces of freehold vacant land, measuring approximately 12.06 acres at Tempat Ladang Valdor, Daerah Seberang Perai Selatan, Penang, one from a related party and another one from a third party.

GUH Realty Sdn. Bhd., a wholly-owned subsidiary of GUH Asset Holdings Sdn. Bhd., which in turn a subsidiary of GUH, had on 09 September 2015, entered into the Sale and Purchase Agreement with one related party, known as Leader Holdings Sdn. Bhd, and another one, a third party to acquire all that freehold vacant industrial land held under Lot 1377 and Lot 1690 Mukim 12 Seberang Perai Selatan, Penang for a consideration of approximately RM22.60 million.

The Proposed Acquisitions are in line with the ongoing plan of the GUH Group to increase and diversify its property land bank in strategic locations with high development value and the subsequent proposed development of a light industrial park is part of the GUH Group’s continuous effort to increase and sustain its earnings growth in the property development segment. With the opening of the second Penang bridge, the mainland’s property market is set to grow. This is partly because of development land is scarce on Penang island while the prices are high. Other growth factors include an increase in new industrial set-ups and the inflow of investment into the mainland, particularly South Seberang Perai. (Source: The Edge Malaysia Weekly, on April 21 - 27, 2014). The Lands are strategically located at South Seberang Perai which has seen the initiation of various government economic programs in the South Seberang Perai District such as the development of Batu Kawan Industrial Park. With an increasing number of local and multinational companies announcing plans to set up factories in South Seberang Perai over the next few years, the management of GUH believes that there will be growing demand for light industrial factories from small and medium size suppliers who would want to be located within close proximity to their customers.

2016

GUH Capital Sdn Bhd (“GUH Capital”), a wholly-owned subsidiary of GUH had entered into a subscription agreement (“Subscription Agreement”) to subscribe for 1,166,667 New SIEG Shares to be issued by SIEG, representing an approximately 25% equity interest in SIEG after the Proposed Subscription, for a total cash consideration of RM11.0 million (“Subscription Consideration”). Upon completion, SIEG become an indirect associate of GUH Capital.

Rationale of the Proposed Subscription

In both the past and current practice, GUH has been investing any excess internally generated funds which are not required for immediate use in short-term money market. GUH is continuously evaluating investment opportunities with a view to increasing its shareholders’ value, and takes a long term view in its investment approach. The Proposed Subscription provides GUH with an opportunity to invest in other businesses with good growth prospects, where we have considered the prospect of SIEG and the private education sector and believe that it can contribute positively to the Company.

GUH Asset Holdings Sdn Bhd (“GUH Asset”), a wholly-owned subsidiary of GUH had entered into a share purchase agreement (“SPA”) with Dato’ Sri Dr. Vincent Tiew Soon Thung and Ong King Seng (the “Vendors”) to acquire the entire issued and paid-up capital of Milan Diamond Sdn Bhd (MDSB) consisting of two (2) ordinary shares in MDSB for a cash consideration of RM2.00 (“Purchase Consideration”) and settlement of liabilities of approximately RM6.77 million (“Settlement of Liabilities”). Upon the completion of the Proposed Acquisition, MDSB will be a wholly-owned subsidiary of GUH Asset.

As part of GUH’s contribution to the foregoing business of SIEG in the Proposed Subscription, GUH intends to procure MDSB together with the Land for building of a school campus and to be leased to SIEG and KKS. The Proposed Acquisition is anticipated to provide GUH with a source of recurring rental income after the school campus is built.

2018

GUH entered into a Lease Agreement with Leader Solar Energy II Sdn. Bhd. to lease part of its agricultural land measuring approximately 71.967 acres or 3,134,865 square feet situated at Lot No. 5, Pekan Bukit Selambau, Daerah Kuala Muda, Kedah held under Geran No. 87076 for a period of 23 years.

The Leased Land is currently used for oil palm plantation. The last few years have seen a slowdown in the global economic outlook presenting multiple challenges to the palm oil industry. The economic return of the plantation is very much dependent of the volatile crude palm oil (CPO) price. As a result of the above mentioned volatile macroeconomic and industry conditions, the profits of plantation have gradually declined over the last few years. The Leased Land is currently planted with aged oil palm trees due for replantation. As compared to volatile plantation income, the Transaction will provide a stable and constant stream of income to the Company. Further, there is no plan to develop the said Leased Land in the immediate future.

2020

GUH Renewable Energy Co., Ltd. (“GUHRE”) (Company Registration No.: 83177643) a wholly-owned subsidiary of the Company has entered into a Memorandum of Understanding (the “MOU”) with Hsinjing Holding Co., Ltd. (“Hsinjing”) (Company Registration No.: 83423700) a company incorporated in Taiwan (R.O.C.).

GUH Renewable Energy Co., Ltd., has also entered into a Memorandum of Understanding (“MOU”) with Yabisi Solar Power Co., Ltd. and Hsinking Co., Ltd., both companies incorporated in Taiwan (R.O.C.).

The collaborations are to provide opportunities for GUHRE to work with experienced local Taiwanese renewable energy players in acquiring renewable energy projects in Taiwan (R.O.C.). The collaborations are in line with the Company’s business strategy to create potential for the Company to add a steady revenue stream from abroad.

The MOUs were entered solely for purposes of a signing ceremony and shall not have any legal effect on any prior or subsequent agreements between the parties or their related entities.

2021

GUH through its wholly-owned subsidiary, GUH Utilities Holdings Sdn. Bhd. ("GUH Utilities Holdings"), has entered into a Share Sale Agreement and other related agreements with HNG Capital Sdn. Bhd. on 2 March 2021 for the disposal of 9,180,000 ordinary shares, representing 60% of the issued share capital of GUH Utilities Holdings' wholly-owned subsidiary, GUH Renewable Energy Sdn. Bhd. ("GUHRE") for a total consideration of RM9,147,319 satisfied entirely by cash.

As a result of the said disposal, GUHRE has become an associate of GUH venturing into power generation projects/opportunities in Taiwan (R.O.C.) and has changed its name to Leader GUH Renewable Energy Sdn. Bhd. with effect from 8 April 2021.

GUH Capital Sdn. Bhd. ("GUH Capital"), a wholly-owned subsidiary of GUH Holdings Berhad has completed the Share Purchase Agreement ("SPA") with Tenby Educare Sdn. Bhd ("the Purchaser") for the disposal of its entire investment of 1,166,667 ordinary shares in Straits International Education Group Sdn. Bhd. ("SIEG"), representing approximately 25% of the issued and paid-up share capital of SIEG.

With the completion of the disposal, SIEG ceased to be the indirect associate of GUH.

2022

GUH Capital Sdn. Bhd. ("GUH Capital"), a wholly-owned subsidiary of GUH Holdings Berhad has entered into a share purchase agreement to acquire 5,500 ordinary shares, representing 55% equity interest in Star Wheels Electronic Sdn. Bhd. ("SWE") for a cash consideration of RM1,100,000.00; and a share subscription agreement to subscribe 5,000 new ordinary shares in SWE for a cash consideration of RM1,000,000.00.

As a result of the completion of the acquisition and subscription of shares, SWE is now a 70%-owned subsidiary of GUH Capital.

2023

GUH eVehicle Sdn. Bhd., a subsidiary of GUH Holdings Berhad, signed an MOU with Jiangsu Xinri International Trading Co., Ltd., appointing GUH eVehicle as the exclusive representative to market, promote, distribute, assemble, manufacture, and sell electric vehicles supplied by Xinri International in Malaysia.

Xinri International, an experienced and reputable manufacturer of electric vehicles will assist GUH eVehicle in setting up an assembly plant if necessary.

The electric vehicle industry in Malaysia holds strong growth potential due to climate change efforts, presenting significant opportunities for GUH eVehicle.

Due to increasing competition in its core contributors, and in order to mitigate reliance on its existing activities as well as to diversify its earnings moving forward, GUH Group is continuously seeking opportunities to diversify into other viable businesses, including renewable energy and related activities. The proposed diversification has been approved by the shareholders during the Extraordinary General Meeting on 31 May 2023.

On 17 July 2023, Leader GUH entered into an agreement to divest its entire 60% equity stake in Yabisi Solar Power Co., Ltd. for NTD21,208,718 (equivalent to RM3,111,425). Upon completion of this transaction, Yabisi Solar Power Co., Ltd. ceased to be a 24%-owned associate of GUH, marking a strategic adjustment in GUH's portfolio.

GUH through its subsidiary GUH Capital Sdn. Bhd., has entered a Cooperation Agreement on 10 November 2023, with Shenzhen Xixin Electronic Technology Co., Ltd. to jointly establish a lithium battery assembly plant for markets outside China.

Effective 16 June 2024, both parties have mutually agreed to terminate this agreement. The termination has no financial impact on GUH and its subsidiaries, and no conflicts of interest exist among its directors, major shareholders, or affiliates.

2024

Teknoserv Engineering Sdn Bhd a wholly-owned subsidiary of GUH has accepted a subcontract from Gamuda M&E Sdn Bhd on 30 April 2024 with a total value of RM69,491,717.00, inclusive of all taxes and duties. The sub-contract work includes the supply, delivery, installation, testing and commissioning, as well as maintenance of mechanical and electrical process, surface aeration system, destratification system and algae control system for intake and raw water pumping plant and ponds.

Corporate Fact Sheet

Registered Office

Part of Plot 1240 & 1241

Bayan Lepas Free Industrial Zone Phase 3,

Bayan Lepas 11900 Penang

Phone: +604-616 6333

Fax: +604-616 6366

Website: www.guh.com.my

Share Registrar

Mega Corporate Services Sdn. Bhd. (198901010682(187984-H))

Level 15-2 Sheraton Imperial Court

Jalan Sultan Ismail 50250

Kuala Lumpur

Phone: +603-2692 4271

Fax: +603-2732 5388Website: www.megacorp.com.my

Company Secretaries

Datuk Seri Kenneth H’ng Bak Tee (LS 0008988)

Ms Kee Gim Tee (MAICSA 7014866)

Bankers

CIMB Bank Berhad

Stock Exchange Listing

Listed on the Main Market of

Bursa Malaysia Securities Berhad

under Industrial Products Sector

Stock Code: 3247

Stock Name: GUH

Independent Auditors

Crowe Malaysia PLT (201906000005(LLP0018817-LCA) & AF1018)

Chartered Accountants

Level 6 Wisma Penang Garden

42 Jalan Sultan Ahmad Shah

10050 Penang

Phone: +604-227 7061

Fax: +604-227 8011Website: www.crowehorwath.com.my

Mission

For Its Shareholders

-

Practice good corporate governance to enhance transparency

-

Identify profitable ventures and business development to maximise shareholders’ value

-

Provide good dividend payment

For Its Employees

-

Provide a conducive working environment

-

Provide proper training, development and opportunities for career advancement

-

Recognise and reward excellent employees

For Its Suppliers/Vendors

-

Impartiality in the selection of suppliers/vendors

-

Effective communication to facilitate suppliers/vendors' timeliness and quality

For Its Customers

-

Respond efficiently to the changing demands of the customers

-

Improve product quality and technical innovation to fulfill customers’ needs and satisfaction in the market place

For Its Community

-

Integrate environmental protection into its business and to minimise environmental impact

-

Uphold its corporate responsibilities for the benefits of the community